Movies show colleges clichés, like memories that you’ll make with friends and meeting the love of your life in class. They seem to leave out the elephant in the room: loans.

The mountain-sized pile that you get trapped under trying to pay for these “memorable moments” and gourmet food (which is not all it’s cracked up to be). I absolutely hate them. They are the evil little critters that creep into your mind when you realize you can’t keep your full paycheck because you need to pay your monthly interest.

Loans keep me up at night.

I grew up with my parents taking out loans here and there for different things. I always assumed that it counted as a normal thing to do. Oh, how I was so wrong.

As I got older I started to realize the strain that these loans put on my family. I decided that I would never take out a loan. I didn’t want to follow in my parent’s footsteps; I wanted to make money and save it. Simple as that.

When I started applying to colleges my senior year, I sat down with my counselor to discuss how I would pay for college. My family made too much money to be considered for a full ride. But we also didn’t make enough that my parents could actually afford to pay for my education.

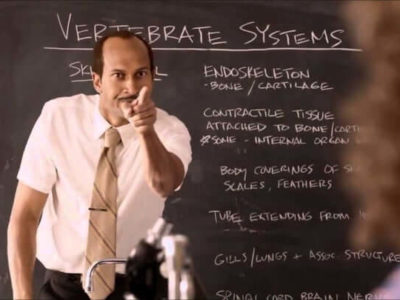

That left me with one choice: I needed to take out *sigh* loans. I felt so sure that I would hate every second of the conversation with my counselor. He couldn’t tell me anything that I didn’t already know. Loans dig you into a hole that you will never escape out of debt free.

But despite my negativity, I listened. I took mental notes so I could tell my parents what my counselor said to me. He knew about my feelings towards loans and tried to show me the benefits of taking them. “It’s an investment for your future,” he said. “If you’re willing to take out loans on a car or a house, then you should be willing to do the same for your education.”

His words spoke volumes to me. I talked to my parents that night and continued applying to more colleges. Now I felt comfortable with the loans I would need to fall back on to pay for college.

Finals. Prom. Graduation. The rest of the year passed by in a blur and before I knew it, I started packing for my freshman year at Boston College.

I was in the process of applying for a loan one night with my parents when my father decided to blow a gasket about the $10,000 loan that I needed to take out (mind you, he’s known about this for quite some time now).

This outburst makes me start to second-guess myself. Am I making the right decision? Is this institution really worth it? So many questions flew around my head that I needed to go to my room and cry. I cried for my worries, my parents and their reservations about my choice. All-in-all, it was an intense night.

August 27, 2017 marked the first day of classes. I got off the bus to head to my first class. I felt completely mesmerized by the scenery and the gothic architecture of the buildings that surrounded me. The other students bustled around, rushing to get to class with their eyes half-open and a mug of coffee in one hand.

I followed the wave of students and rushed to my class and sat down. My knees constantly bobbed at 85 mph. Once class began, the nerves settled down. I was 100 percent focused. The professors’ intelligence awed me. I felt certain that I had chosen the right college. My certainty continued to grow throughout the day.

That’s when I realized that loans weren’t the villain in the story, but the fairy godmother. If not for the loans, I wouldn’t make it to this prestigious institution, learning like I am.

If I stayed home (AKA the only place I could truly afford), then I would go to class and straight home after. Boston College was my place. I am challenged here in ways that I wouldn’t have been back at home. I’m forced to meet new people and join clubs and activities so that I won’t feel lonely. None of this would be possible without loans.

But everything comes with a price. The interest rates for loans suck. And I needed to take out $10,000 for just freshman year. This year, it costs me almost twice that amount to go to school. Insane, right?

Trust me, I had an extremely hard time accepting this fact. And yes, I cried about it. I gave myself a few pity-party minutes.

Then I began to look at it positively and think to myself: If I attend a school that cost around $73,000 a year and I only need to pay a quarter of that amount, then I think I’m doing pretty good. These sacrifices make life worthwhile.

Loans put people into debt and that scares a lot of people, including me. But that doesn’t mean that they’re inherently bad. Loans present opportunities. They gave my parents a chance to buy a house and cars.

I used to be completely scared of loans and the dollar amounts they represent. Who knew that I only needed a caring counselor and the right tools to figure out the best path to take. Could you believe it? The thing that I hated and feared most actually saved me.