FICO. Credit scores. Bank statements. And so forth. These statements all seem to shake hands on one thing: none of them were ever explained to us in our ripe age, and they’re all about to become very, very important. However, what is FICO anyways? Why is it important, even during college? And, most importantly of all, how can you build a credit score without screwing yourself over?

Read on for helpful info, as well as a few tips, to ensure your credit success in the future.

So, what is FICO?

FICO, short for the original company name Fair Isaac Co., is essentially the company that measures and evaluates the majority of banks’ credit scores. Although it is certainly not the only producer of credit scores, it’s definitely one of the largest. “The FICO score itself is a measure of consumer credit risk. It’s one of many existing models of credit scoring: the purpose of credit scoring is to determine credit-worthiness of an applicant,” said Hills Bank Representative Molly Wilson. Think of it as just another service that provides your credit score.

But what is a credit score?

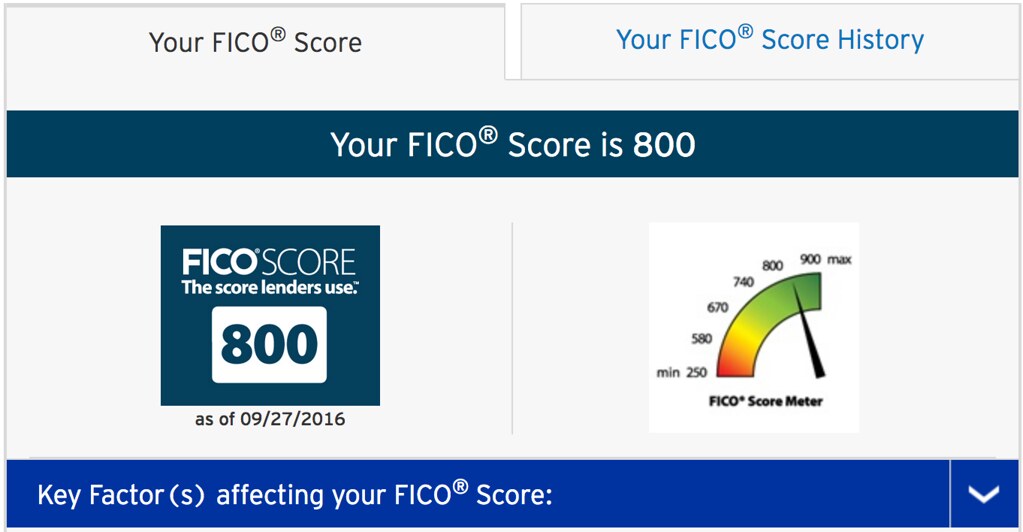

Ah, so glad you asked, metaphorical person in computer form. A credit score is more or less the financial representation of how reliable a consumer and spender you are. A business-like FICO or VantageScore takes the data from your credit reports, such as how much debt you have, whether your bills have been paid and so on. From there it measures how likely it is that you’ll pay any more hypothetical bills in the future. The typical range goes from 300 to 850, and you typically want to find yourself in the 730 to 750 range.

Why is it important?

It’s incredibly important, not necessarily to you right now, but you’ll really do your future self a favor if you’re trying to, for example, buy a big-kid house or apply for another loan or buy your own car. “When you work on these things as an undergrad, you’re positioning yourself well to get more favorable credit terms as you do begin to make larger purchases. It also means that when you finish college, you will have already established good financial habits,” said Wilson. That kind of long-term plan might not occur while you’re just trying to navigate your way around the dorms, but it’s something you should most definitely keep in mind.

How do you build good credit?

Yes, my favorite question. This is so much easier to do than you would think. For starters, you can head to your bank on campus and ask to see a personal banker about a “college card.” This is essentially a credit card for those afraid of the word “credit” (in my personal experience, at least). It’s important that you monitor this account. “During college, it’s important to live within your means. If you take out student loans to help pay for college, pay attention to those loans and deferment periods. Be mindful of how much you are borrowing, and limit these amounts if possible,” said Wilson.

They always make the jokes in the movies about the “emergency” credit card being used to order pizza or go shopping, but one pro tip: do not do this. You can likely use the card like that when you’ve built more credit and gathered a higher minimum, but for the time being, do not. Before you know it, you’ll find yourself neck-deep in statements that you need to pay off, and that’s not fun. “If you decide to open a credit card in college, we often recommend just choosing one type of purchase (like Netflix or gas for your car) and only charging that to your credit card. Then pay that expense off by the bill due date. This will allow you to use your credit card responsibly and build credit without racking up a balance and paying interest,” said Assistant Director of Financial Literacy & Counseling Kelsey Ryder.

What’s the long-term plan?

This is a tricky one because the lenders produce credit scores based on consistency and reliability. “If you do have a credit card, work to keep the balance below 50% of your credit limit. Ideally, you should pay the balance in full each month. Make timely payments on any credit cards or loans, making sure that you are cognizant of due dates: the best way to build a good credit score is to show a long pattern of on-time payments to creditors,” said Wilson. It feels like a waiting game for a statement, but it shows punctuality to pay a statement exactly when it’s due.